A Guide to Applying for the Wells Fargo Reflect Card

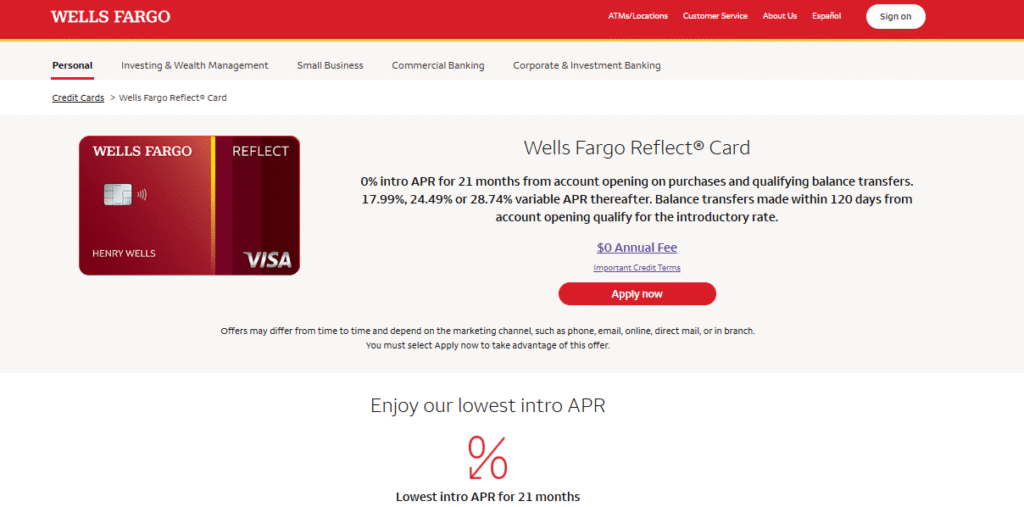

If you’re seeking a straightforward and quick method to obtain flexible credit, whether you’re establishing or re-establishing your credit, the Wells Fargo Reflect Card might be just what you need.

It boasts one of the longest 0% introductory APR durations available in the U.S. — up to 21 months on purchases and balance transfers — with no annual fees and no hidden costs.

Everything can be managed online or via your phone, eliminating the need to visit a physical branch.

The best part? Once you’re approved, you can immediately use your digital card, securely and conveniently, right from your mobile wallet.

Curious about how to apply swiftly and with confidence?

Check out the step-by-step instructions below and learn how to obtain your Reflect® Card hassle-free.

Who is Eligible to Apply for the Wells Fargo Reflect Card?

Individuals 18 and older with a valid U.S. address and social security number are eligible to apply for the Reflect Card.

You’ll also require a valid email address, an active phone number, and a checking account for online transactions and payments.

Here’s the good news — no proof of minimum income is needed.

Your eligibility is assessed digitally based on your current financial profile, making it accessible for many applicants, including those working on their credit.

Step-by-Step Guide: Applying for the Wells Fargo Reflect Card

Getting your Reflect® Card is easy, entirely online, and takes just a few minutes.

You can handle everything from your phone or computer and start using your card immediately after approval.

Here’s a simple guide! 👇

1️⃣ Visit the Wells Fargo site: Go to wellsfargo.com/reflect to kick off your application.

2️⃣ Enter your information: Fill out your personal and financial details for a quick credit assessment.

3️⃣ Await approval: Wells Fargo quickly reviews your application and informs you of your approval status—often in just minutes.

4️⃣ Check and accept terms: After approval, review your rates and conditions carefully, then accept them online to activate your account.

5️⃣ Use your card right away: Your digital Reflect® Card will be available in your mobile wallet for immediate use—no need to wait for a physical card.

Once your application is approved, your digital access activates instantly.

Wells Fargo ensures a secure, paperless experience, allowing you to manage your card and transactions with clarity via the Wells Fargo Mobile® App.

Everything is handled digitally, with no intermediaries and complete transparency, giving you the credit you need swiftly and safely.